American vs Canadian FinTech Ecosystems

By Alex Tong and the Information VP team

Fresh from the news that FinTech investment has reached an all-time high in Q3 2021, more eyes are on the entire FinTech ecosystem. While much of that attention is being paid to major markets – America, Asia, Europe – I want to highlight that America’s neighbours to the North are punching well above their weight.

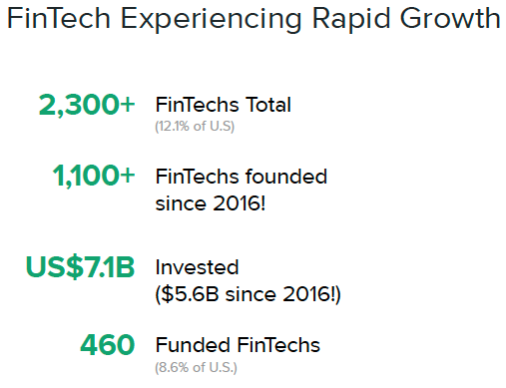

Often overlooked in comparison to its neighbour to the south, Canada’s FinTech ecosystem is growing rapidly and is taking advantage of the impressive tech talent located here. Many are unaware of the country’s impact, unsure how a country of just 37 million could boast over 2,000+ FinTech companies.

As more attention is being paid to the FinTech space, I thought it was an opportune time to go into a bit of depth about the Canadian ecosystem. I will illustrate how the Canadian banking system differs from America’s (and why that matters), who some key players are in the Canadian FinTech space, and why it’s worth paying attention to this market.

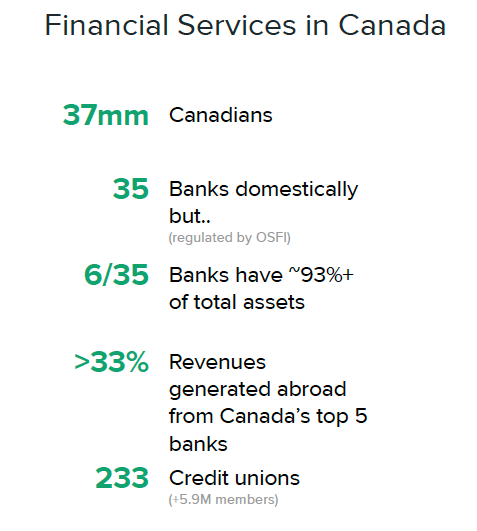

Financial Services in Canada

While the rule of thumb of roughly one-tenth of the population compared to the U.S. tends to remain true in most statistics, the rule is broken in relation to the different banking systems. The U.S. has roughly 9,000 banks, credit unions, and community banks dotted throughout the country. Canada, on the other hand, really only has 35 domestic charter banks, plus a few foreign bank subsidiaries. Additionally, unlike the U.S., six of the thirty-five banks comprise roughly 93% market-share in terms of assets.

As these six banks dominate the Canadian marketplace, it often surprises people to learn that they punch above their weight internationally as well. Roughly 33% of revenues are generated abroad for the top five banks. Canadian financial institutions seem to manage to not only be dominant at home but make a meaningful impact in international markets.

Just to give you a better sense of their asset size, the big five banks in Canada, if they were placed against the American banks, the “big five” would be amongst 10 largest banks in the U.S. by assets. So, Canada truly has some sizable institutions here despite the one-tenth population size dynamic.

Less discussed in these comparisons is the vibrant credit union market in Canada. There are 225 credit unions, mostly capturing underserved markets in this sprawling country. The asset size of some of these credit unions really is comparable to the American credit unions, with some well over $5 billion in assets.

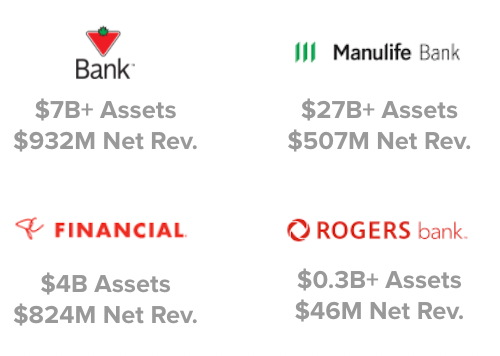

Finally, an element to both countries’ ecosystems is the concept of partner banks. The rule of one-tenth plays in once again here with America counting well over 30 partner banks (with announced FinTech partnerships) both large and small, while Canada has a small grouping of approximately three (publicly announced). However, challenger banks do exist in Canada – they are just sponsored by existing trusted brands like Canada’s leading grocery chain, retail goods chain and telecom company.

There’s a lot of conventional and non-conventional participants in the Canadian FinTech ecosystem, which can create interesting opportunities for not only partnerships but innovative new challengers and FinTech startups.

Rising FinTech Stars

As a FinTech VC, I have never seen so many companies in Canada get funded, founded, and exited than in the last couple of years. As you can see in the chart here, over half of the FinTech startups in Canada have been founded since 2016 alone. And the rapid growth is reflected in the amount of investment pouring in.

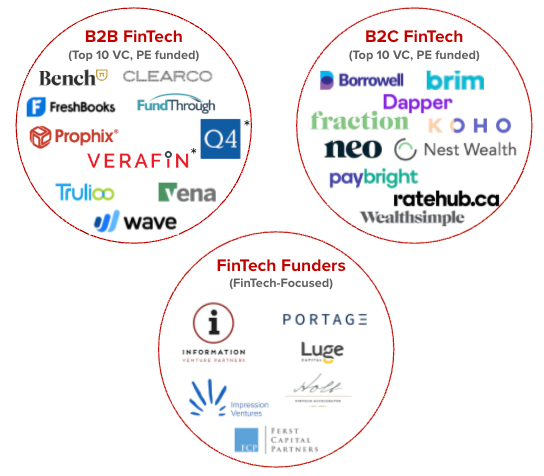

Additionally, many of these Fintech startups are becoming household names both here and abroad. I’ve included just some of the companies that have been funded in the image below.

On the B2B side, there are true best-in-class companies and innovative business models coming out of Canada recently. ClearCo, for one, has quickly made a name for itself (even with the name change from Clearbanc) in the investment world, with their merchant cash advance model and recent round of $215M which was led by SoftBank. And Verafin, though not in as flashy of a market and from one of the smaller provinces, Newfoundland, was recently acquired by NASDAQ for nearly US $3 billion.

acquired by NASDAQ for nearly US $3 billion.

On the B2C front, there’s a growing and exciting cohort of companies that are breaking into international markets. KOHO, one of the most well-known B2C FinTech companies, recently raised a $70 million Series B round as they scale their digital banking services. As well, Wealthsimple a roboadvisor that automates investing and savings for retail consumers, has become very well-known south of the border and is extending well beyond just roboadvisory into other areas of FinServ with its own version of cash app.

And on the funding side, Canadian VC firms that are focused on FinTech, like Information Venture Partners, have deep domain expertise and experience as well as the networks to help grow these startups. However, there’s also more interest coming from abroad too, accelerated in the last year as a result of COVID and the new ways of accessing startups, as internationally-based VCs are starting to catch on to the opportunities in the north.

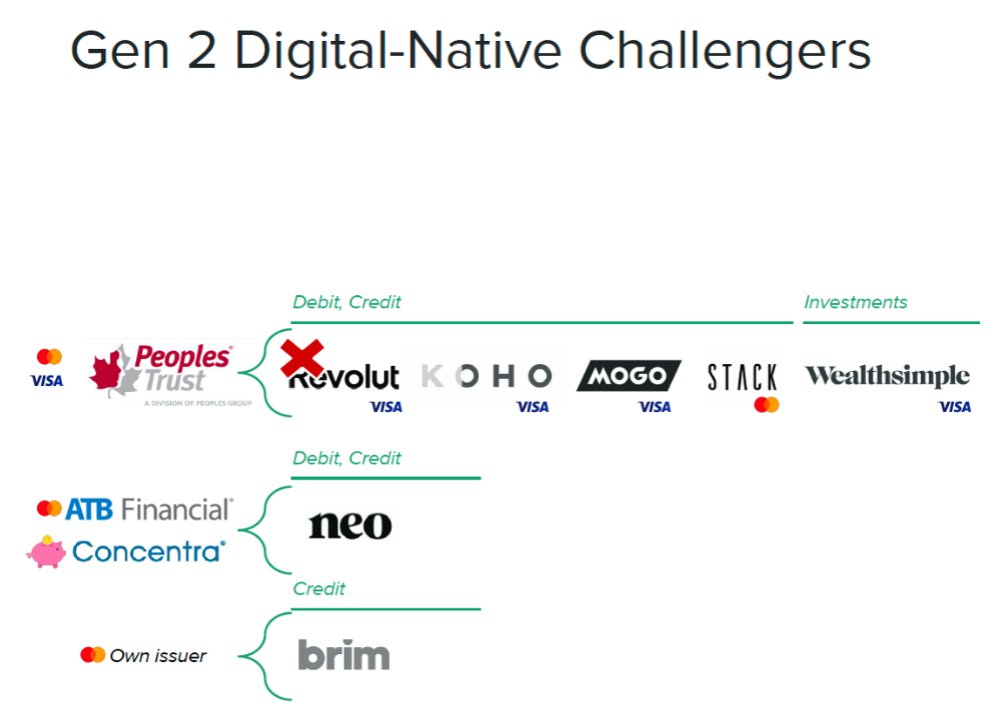

Finally, there are some challengers to the traditional financial structure in Canada that are supported by the partner banks. These digital-native challengers have an opportunity to truly modernize the market here by unbundling some of the core banking offerings.

Finally, there are some challengers to the traditional financial structure in Canada that are supported by the partner banks. These digital-native challengers have an opportunity to truly modernize the market here by unbundling some of the core banking offerings.

Why Canada Will Get Bigger

With a big, established financial services industry and FinTech startup ecosystem, Canada is poised to usher in new innovations that both disrupt and work within the current structures. There are two main reasons why this country is uniquely set up to take on these big challenges, especially in the B2B/FinTech SaaS areas.

The first is that the financial hubs of Canada overlap 100% with some of the top universities in the country. Toronto, North America’s second largest financial hub, has the University of Toronto, which is consistently ranked one of the best institutions in the world, as well as other major engineering hubs like University of Waterloo nearby. Montreal, which has a strong derivatives exchange and a lot of activity around crypto, is equally supported by McGill University. This combination of tech talent and financial services talent creates interesting opportunities for truly empathetic problem solving and collaboration.

And the second is that Canada is a “net exporter”, not only in the traditional trade of goods and services, but also in software and technology. Canada has been able to “punch above its weight” and achieve global / G7 scale, in part by partnering with buyers (software buyers included) in other markets. Startups here are told early on to think globally about their ventures and they do exactly that. There are certainly examples of Canada-only winners, which we should continue to develop and champion, but many companies look internationally very early on in their journey.

Opportunities to Grow

There are some interesting dynamics at play in the Canadian FinTech ecosystem that set it up well to be a major player. As more attention is paid to the investments in this space, I encourage you not to disregard the “friendly neighbour to the north”. The financial services system here is well regarded, outsized in assets, and willing to partner/support new innovations. Startups here have taken risks and been recognized globally. And the talent pool and mindset of innovators in this country gives it all the right ingredients to be a powerhouse in the FinTech world.

Learn more about some of our Canadian FinTech investments, including Coconut Software, Flybits and Q4.

This blog took slides and themes from a webinar Alex did for “This Week in Fintech”.