Blog Post: FinTech in Québec

Our team recently travelled to Montréal for StartupFest, and were inspired by the innovation that was originating from the region. We decided to take a deeper dive into the ecosystem and find out more about the changes Québec is experiencing in FinTech.

The Market

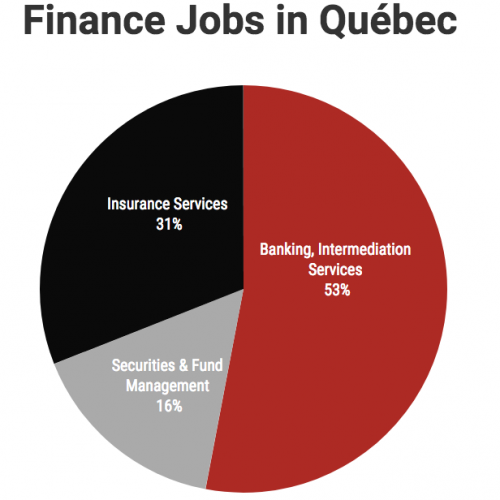

Québec is a strong contender to become a key North American finance hub, housing three of the largest banks in Canada and an emerging FinTech start-up community. According to an article published by the International Financial Center Montréal, “Québec’s financial services industry employs close to 160,000 professionals, with 100,000 working in Montréal.” In total these jobs can be broken down as follows:

Naturally, with a critical mass of finance industry professionals, Québec is well placed to become a cluster for FinTech innovation.

This high growth FinTech market is looking to not only disrupt but partner with the traditional banking systems. According to the Competition Bureau’s FinTech Workshop, Driving competition and Innovation in the Financial Services Sector, collaboration between start-ups and established institutions can lead to excellent outcomes for both parties. Start-ups view this partnership as a way to access incumbent legacy infrastructure and platform technology and achieve scale quicker1.” As we see this market grow in the coming years, we predict to see more disruption and partnerships within traditional banks and insurance companies that will help this sector grow into a vibrant ecosystem.

The Talent

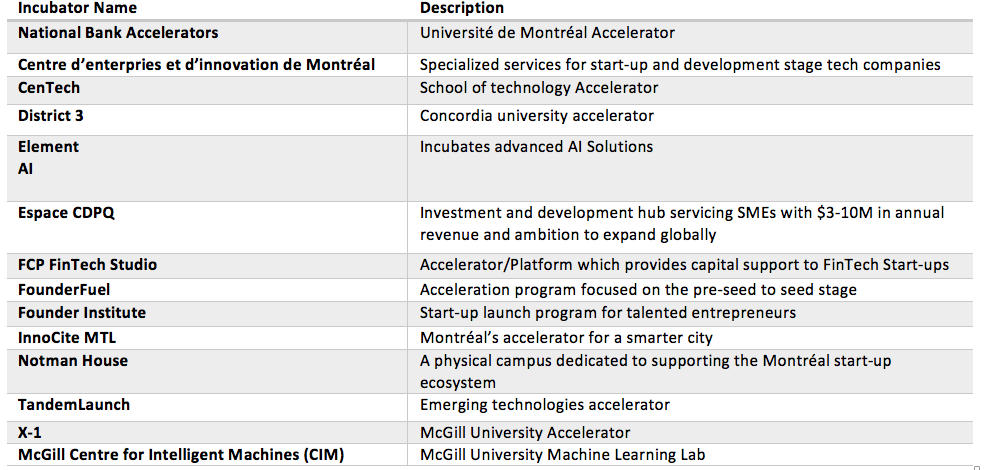

Montréal is home to four major universities: McGill, Université de Montréal, Université du Québec a Montréal and Concordia. These four schools are all producing exceptional talent and have in-house accelerators and incubators to help foster the innovation that the schools are producing. Montréal is also number 1 in North America and 7th worldwide as a destination of choice for international students with 24{0573984a2b8f609c30111d9663e55dcffe5bf46757f544e848868cbca776ed36} of all graduates earning degrees in STEM placing Canada ahead of the UK and the USA1. This stream of talent also has access to various accelerators, incubators and a variety of funding sources including the following3

When we look at the talent in this region, we would be remiss to exclude Yoshua Bengio, a Québécois based computer scientist recognized for his work on artificial neutral networks and deep learning. This pioneer in the field who’s spawned Element AI is assisting this high-growth area of FinTech and helping lead researchers in this region further develop the ecosystem.

This pool of talent, coupled with the resources available in the province, creates ideal conditions for FinTech start-ups to move from proof of concept, to production, to a thriving business.

The Challenges

Working in FinTech can have its own unique sets of challenges especially when disrupting a traditional business model. Among the challenges are: an emerging set of FinTech companies but not a critical mass and the challenge of a long decision-making process by customers.

The FinTech ecosystem in Québec is definitely on the rise. Our survey of the landscape shows various companies present in the region (see: logo chart below). While there are many start-ups that are growing from the region, they have yet to make a large impact on the broader community. This challenge, which is not exclusive to Québec, is slowly being overcome with the help of FinTech specific incubators, accelerators and other resources put in place to help stimulate innovation in this field, along with an increasing willingness from Financial Services firms to partner with FinTechs to help with the evolution of the ecosystem.

Long decision-making processes are not exclusive to only Québec or FinTech for that matter. Financial Institutions can be slow to adopt new technologies into their legacy systems. Many companies are revolutionizing this process, and we predict that decision-making processes will continue to grow shorter over time.

Momentum in Quebec

It is evident that FinTech is on the upswing in Quebec. Between 2013-2015 Quebec’s FinTech investment totalled C$152M which contributed to 50{0573984a2b8f609c30111d9663e55dcffe5bf46757f544e848868cbca776ed36} growth1 between the years 2014 and 2015. The proof of this growth is shown through Montreal-based companies like Lightspeed. In 2015 LightSpeed2 raised C$80 million from the Caisse de dépôt et placement du Québec, Investissement Québec, iNovia and Accel Partners. Jump to 2017 and the pace has quickened with Montreal-based Element AI’s3 C$137.5M Series A raise led by Data Collective (DCVC). It is certainly clear that Quebec has multiple talented FinTech companies and investments pouring into this ecosystem do not show signs of slowing down anytime soon.

There are also instances of Quebec financial institutions backing these FinTech innovations. More recently National Bank4 has invested C$6M into Toronto-based Nest Wealth5 which licenses its investment technology to help its advisors manage clients’ money using digital practices. Another example would be Desjardins.6 Since 2013, Desjardins has collaborated with iMetrik, a Montréal-based company, to implement the Ajusto program, which estimates a driving “score” that converts into a discount on your next insurance subscription. This funding allows the Québec financial institutions to familiarize themselves with FinTech and better utilize it in the future.

Now that Quebec has momentum, the key is sustaining and improving on this success. One key to advancing would be developing a consistent university curriculum in Québec universities7 to advocate the multiple professional FinTech career paths. Another suggestion includes creating a FinTech hub8 to develop Québec’s FinTech ecosystem which also sufficiently backs developing or existing FinTech firms. Everything considered, Quebec is in a promising position to grow and situate itself as a prominent Fintech hub in the future.

At Information Venture Partners, we believe that most regions in Canada are growing FinTech ecosystems with their own unique stages of growth, challenges, and talent. We will however, be keeping our eye on Québec tracking this region carefully to see how it grows and matures into an innovation hub producing exceptional products and talent.

Sources:

[1] http://www.finance-montreal.com/sites/default/files/publications/factsheet_-_montreal_global_financial_centre.pdf

[4] Ibid

[5] Ibid

[7] http://www.finance-montreal.com/sites/default/files/publications/factsheet_-_montreal_global_financial_centre.pdf

[8] http://betakit.com/national-bank-investing-6-million-in-nest-wealth-licensing-robo-advisor-platform/

[9] http://www.finance-montreal.com/sites/default/files/publications/factsheet_-_montreal_global_financial_centre.pdf

[10] Ibid

[11] Ibid